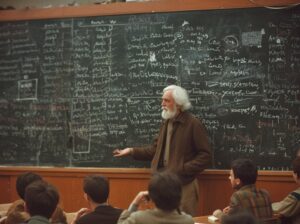

Income Components in the Italian and International Experience: From the Contraposition between Ordinary and Extraordinary Costs and Revenues to the Contraposition

The costs and revenues recognised in the profit and loss for users outside the company have evolved in various countries and at the level of international accounting standards concerning the juxtaposition of large aggregates of negative and positive income components. Over time, there was talk of costs and revenues without any contraposition whatsoever, even going so far as to state that a profit and loss was perfectly valid with three items recorded in such a document: total costs, total revenues, profit or loss for the year. Over time, this situation has completely changed both in Italy and internationally. In the 1990s, the profit and loss governed by the international IAS and the profit and loss governed by Italian civil law presupposed the contraposition of extraordinary costs and revenues. After this contraposition had been eliminated at the international level, discussions began in Italy about whether the contraposition between extraordinary and ordinary income components could be replaced with another contraposition using the term ‘extraneousness’ or ‘not extraneousness’ to the company’s activity. After this evolution, at present, both at the international level and at the Italian national level of all countries that refer to IAS/IFRS as elements that should be, in the medium to long term, introduced in all national legislations at least in Europe and, there is no longer any contraposition between negative and positive income components therefore, according to the contrapositions with the above all income components are ordinary, and all income components are not extraneous to the business.