Financial Modeling with Geometric Brownian Motion

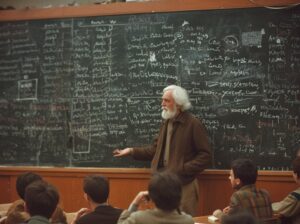

This project evaluates the Brownian Motion model’s effectiveness compared to historical stock market data. This paper analyzes its potential reasons for inaccuracies across time spans, specifically delving into its inability to incorporate major events such as the COVID-19 pandemic and the 2008 stock market crash. The paper uses the 2008 stock market crash and the Great Depression example instead of the COVID-19 pandemic to allow long-term accuracy to be tested. A prominent element of this model is the stochastic differential equation, which represents the randomness and uniqueness that the price of a derivative depends on. Stochastic elements reflect factors that influence the value of a derivative, like time, volatility of the underlying asset, interest rates, and other market conditions. The Markov property simplifies this complicated figure, meaning that the future value is independent of past prices. The Markov property is a “memoryless” feature; the current price is the only factor in future pricing, aligning with the effective market hypothesis. Finally, the paper offers insights on enhancements to the model, adjusting it to be a more efficient tool for economic forecasting.